Software-as-a-Service (SaaS) was the golden child of the tech world. Companies raised millions, new tools launched every month, and growth charts always seemed to point upward. But even the fastest-moving industries eventually slow down. Growth stalls, customers hesitate, and investors begin asking tougher questions. It feels uncomfortable, but it’s also a normal stage of business. The real question becomes: what happens after the growth rush ends?

Why Growth Slows Down

SaaS companies rarely stop growing overnight. Instead, it’s a mix of challenges that come together. As more players enter the same market, tools start to look alike, and it gets harder to stand out. Many companies also face market saturation, where the easiest customers are already signed up, and finding new ones becomes costly. Subscription fatigue plays a role too. Businesses often juggle dozens or even hundreds of apps, and at some point, finance teams begin cutting back. On top of that, economic pressure makes companies re-evaluate every tool they use, and software that isn’t essential is usually the first to go. Growth stalls not always because of a bad product, but because the market and environment shift.

The Shift From Speed to Strength

When growth slows, the smartest SaaS companies adjust their focus. Instead of endlessly chasing new sign-ups, they start thinking about how to make sure the customers they already have never want to leave. Retention becomes more important than acquisition. Pricing models evolve so customers can pay for what they actually use rather than being locked into rigid plans. Operations also become leaner, with companies learning to do more with smaller, sharper teams. This isn’t a sign of failure, it’s the moment the business grows up.

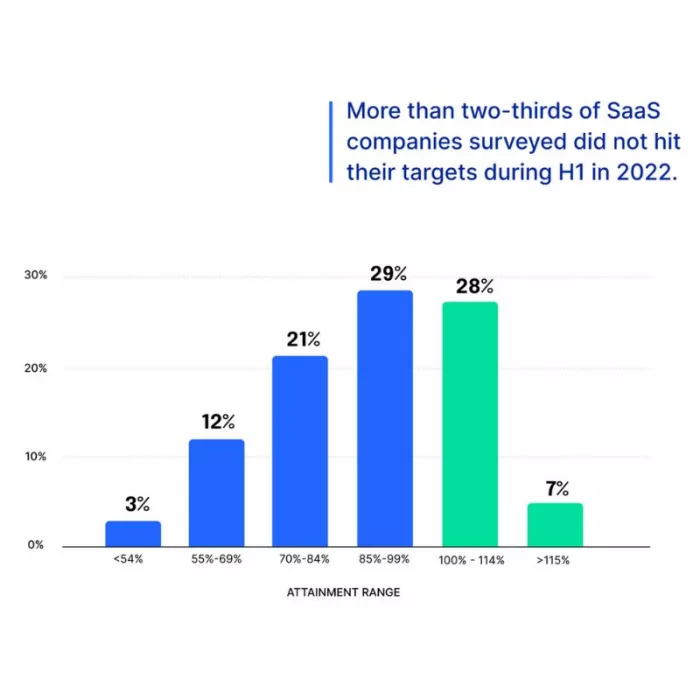

The Numbers Back It Up

Industry research shows this shift clearly. In the early years, SaaS companies often grew by 30 percent or more annually. Today, growth averages closer to 15 to 17 percent. These numbers are still strong, but they represent a steadier pace compared to the frenzy of the past decade. Public SaaS companies also no longer trade at sky-high valuations like they did in 2021. Investors are looking for sustainability and efficiency, not just speed.

Where SaaS Companies Go Next

So what do SaaS companies do once growth slows? Some double down on specific industries, creating highly specialized products instead of broad solutions. Others evolve into full platforms, expanding into related services and becoming central to their customers’ entire workflow. Many look beyond the saturated U.S. and European markets to regions like Asia, Africa, and Latin America, where there is still room for expansion. Artificial intelligence is also reshaping SaaS, not as a gimmick but as a built-in feature that makes tools smarter and more efficient. And when organic growth is hard to achieve, mergers and acquisitions often become a path forward, allowing companies to expand faster than they could by building everything in-house.

The Human Side of Slowdowns

The slowdown isn’t only about numbers. It has a human impact too. Teams that were used to rapid hiring and big wins may feel discouraged when things no longer move at lightning speed. This is where leadership plays a critical role. Success needs to be redefined not just as “more customers and more revenue,” but as loyal relationships, stronger products, and businesses that can weather tough times. Adjusting this mindset is challenging, but it’s what separates companies that last from those that fade away.

SaaS Isn’t Ending, It’s Evolving

A slowdown doesn’t mean the SaaS model is broken. It simply means the era of endless expansion has matured into something more grounded. Instead of chasing speed, companies are learning to value trust, stability, and long-term impact. The first wave of SaaS was about growing fast. The next wave is about growing strong.

Comments